Arizona Housing Crash?

Are Arizona housing prices crashing? Let’s take a look at some of the latest data to find out what’s going on right now.

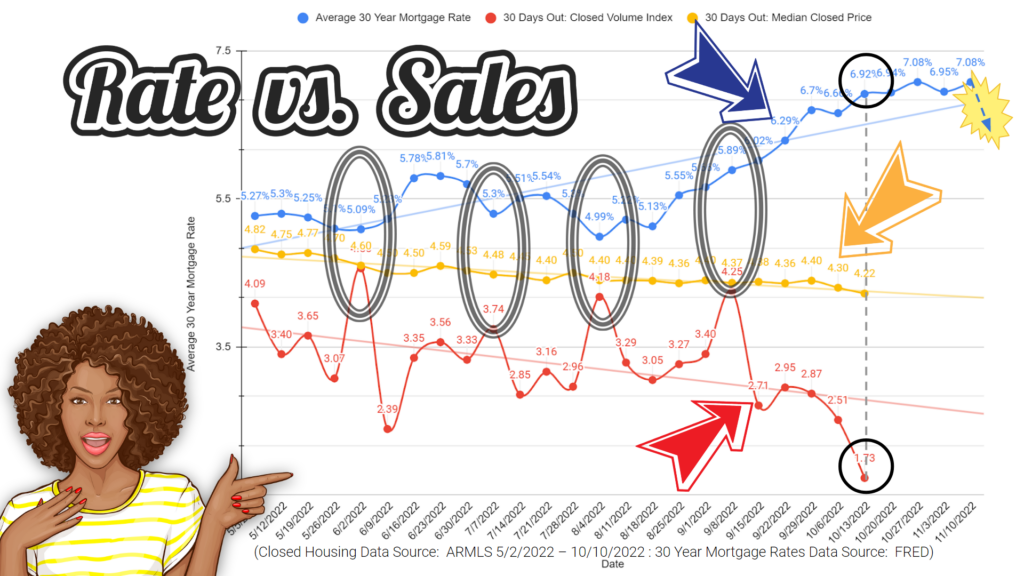

Mortgage Rates vs. Arizona Housing Sales

In order to understand how recent changes in mortgage rates are affecting the Arizona real estate market, this chart shows weekly average mortgage rates and then compares them to an index of sales prices and closed home volume one month later.

The blue line is the average mortgage rate per week. The yellow line is the resulting median sold price one month afterward. And the red line is an index showing the volume of homes sold one month out.

FRED publishes average weekly mortgage rates on Thursdays. So let’s start with Thursday October 13, 2022. That week, 30 year mortgage rates flirted with nearly 7% for the first time in about 20 years. So let’s follow the dashed line down to see what happened one month later. When we do this we can see that a month after the 6.92% average rate, the closed home volume dropped dramatically.

But looking back in time, we can see that the opposite occurred when rates went down. Take a look at early June. Rates dipped to nearly 5% and then 30 days later, the closed home volume index spiked up. And this repeated with subsequent drops in mortgage rates. Interestingly, there was also a spike in closings from homes that went under contract the week right before mortgage rates crossed into the 6% territory.

Rates dropped again dramatically last week, so be sure to check back in a few weeks for an update to see how this will affect the volume of closings.

Impact On Arizona Housing Prices

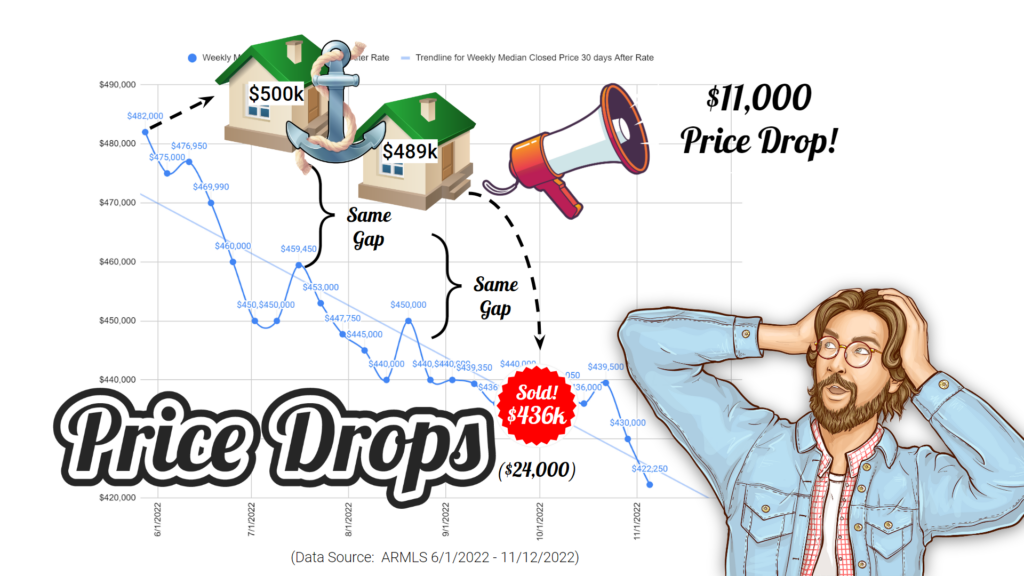

So how are these fluctuations in mortgage rates impacting home prices?

Well, as we can see from the blue line median home prices in the greater Phoenix area have been marching steadily downward. When we overlay mortgage rates in red, we see that rates, by themselves, don’t give an exact indication of price changes. Instead, price changes are ticking down at a more or less steady rate.

Over the past 5 months, this median drop has averaged about $11,000 per month. No doubt, this is a serious drop in equity. But, so far, it doesn’t feel like a total freefall. Instead, it feels more like a controlled price deflation. I think this has a lot to do with the buyer’s purchasing power. As rates go up, buyers can buy less, but more on that later.

Housing Market Price Drops

A fair number of sellers got stuck in a price trap when the market changed from increasing to decreasing prices this summer. The trap looked something like this:

Let’s pretend a seller listed their house for sale in July. To determine the home’s asking price, this seller looked at the prices of recently closed homes and then added a few percent. This seemed like the right thing to do because over the past couple of years, home values continued to increase.

The home would then sit on the market while lower priced comparable homes would go under contract. Realizing that their property wasn’t moving, the seller would then lower their asking price. It would be a drop of maybe $10k-$15k. In this example, we will say that the seller lowered their price by $11,000.

Unfortunately, in the seller’s mind, they were anchoring their price drop to their original asking price. They are thinking, hey, I’m offering a big cut down from my asking price. But sadly, during the time the home was sitting on the market, the market also dropped $11,000. That means that relative to the market, the home was still overpriced by about $40,000 and the price drop was essentially meaningless.

Eventually, this seller realized that they needed to drop their price to an accurate market value to sell it. This is easier said than done because it requires projecting into the future to see where prices are heading.

But they went ahead and made the big price cut and sold their home for $436,000. Which is still a big profit compared to the $298,000 this seller paid for the home in 2019. But it’s $24,000 less than the seller might have received for the home if they had priced it accurately when they first listed the home in July.

Mortgage Rates Impact On Home Sales

So in summary, as mortgage rates fluctuate downward, more homes go under contract. But when rates go up, the buyers back off. When the rates were up in the 7% range in early November, we saw buyers back off big time. This is leading Arizona housing prices to go down.

Declining Buying Power

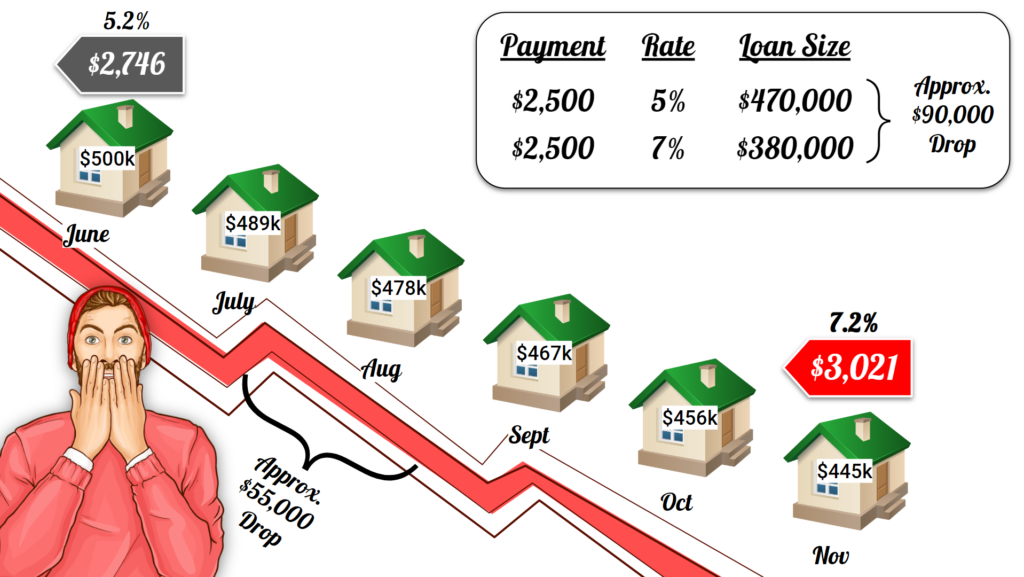

This may have a lot to do with buying power. For example, in recent months when rates hit 5%, a home buyer who is pre-qualified for a mortgage principal and interest payment of $2,500 might be able to get a loan for $470,000. But when rates jumped up to 7%, that same buyer could only qualify for a $380,000 loan. This is a whopping $90,000 drop in purchasing power.

So we are seeing this steady decrease in house prices month over month. At first this may seem exciting to buyers. All in, it represents about a $55,000 drop in the median house price in 5 months. But with rising mortgage rates, a home with a $500,000 mortgage at 5.2% in June would have had a payment of $2,746 per month. But today, a smaller mortgage of $445,000 would carry a payment of over $3,000 at 7.2% interest.

This means that if a buyer couldn’t qualify for a mortgage in June, they have even less of a chance of doing so today. This results in a smaller pool of buyers. So with less demand, the prices of homes are coming down.

Arizona Housing Prices Controlled Burn

This market is certainly painful. Home prices are falling and at the same time, affordability is getting worse. But so far, it’s not feeling like an out of control wildfire. Instead it feels like an agonizing steady burn that the forest managers thought was necessary to control the growth of underbrush.

Federal Reserve Plan for Housing

In the case of the housing market, the “managers” are the people running the Fed. They are raising rates to run an orderly but “painful,” per the Fed’s own words, drawdown in prices. The Fed seems to be in control right now.

As they are raising rates they are bringing home prices down. Once home prices have sufficiently cooled, the Fed is projecting a future where home prices have eased and rates are back to a more manageable level. They tell us that this engineered “soft landing” will be worth all the pain that we are experiencing right now.

In a sense, the Fed is acting like they have super powers. And in a way they totally do. The phrase “don’t fight the Fed” is sound advice. But they don’t control everything. There are always external factors like geopolitical tensions, layoffs, bankruptcies, new real estate technologies, and unpredictable future events that could shift the market in unexpected ways.

What do you think? Will the Fed be able to pull off the real estate “soft landing” they are aiming for? Comment your opinion below.

Keep Up With Arizona Housing Prices

Thank you for tuning into this market update. Subscribe to below make sure you don’t miss the next update. It has no doubt been an unprecedented year in housing. But knowing what’s going on in the market can make it easier to navigate.

Thank you!

This Arizona housing prices update is provided by Clickapro. At Clickapro we are working to arm you with the knowledge and services you need to maintain your home. We are glad you are here and we’ll see you in the next post. Thank you for reading!

Subscribe To Our Weekly Newsletter

Be first to hear about new services and tips for your home.

Data Sources In This Post:

FRED: Average 30 Year Mortgage Rates: https://fred.stlouisfed.org/series/MORTGAGE30US

ARMLS: Arizona real estate listings (subscription required) – https://armls.com/

About This Post:

The data and scenarios in this video are provided without representation or warranty and may be flawed. They are provided for entertainment value only and are not to be used for evaluating real estate or for making financial decisions.

The author of this post, Reid Johnson, is a licensed real estate agent in Arizona and is employed at the brokerage Phoenix View Realty.

Good luck!